How to Start Building an Emergency Fund

Building an emergency fund is a wise financial step that can give you peace of mind and protect you from unexpected expenses. Here’s a step-by-step guide to help you get started!

Key Points

- Set a clear savings goal by determining how much you need for three to six months of living expenses.

- Create and stick to a budget to identify areas where you can save consistently.

- Automate your savings to make steady progress without having to think about it.

- Stay committed over time, knowing that even small contributions add up and provide a financial safety net.

1. Set a Clear Goal

The primary reason for having an emergency fund is to create a financial buffer capable of covering essential expenses, such as medical emergencies, job loss, or unforeseen repairs, without resorting to debt or jeopardizing long-term savings. Determine how much you want to save for your emergency fund. As a general rule, aim to save three to six months’ worth of living expenses. Consider factors such as your monthly bills, rent/mortgage, groceries, transportation, and other expenses.

2. Create a Budget

We understand that building an emergency fund can seem daunting, especially if you’re living paycheck to paycheck. However, the key is to start small and remain consistent. Even saving a few dollars each week can add up over time. Track your monthly income and expenses to understand your cash flow better. Identify areas where you can cut back on non-essential spending to contribute more toward your emergency fund. Nerd Wallet provides a free 50-30-20 budgeting calculator to help you get started. The idea is to put 50% of your income towards things you need, 30% towards things you want, and 20% towards savings and debt repayment.

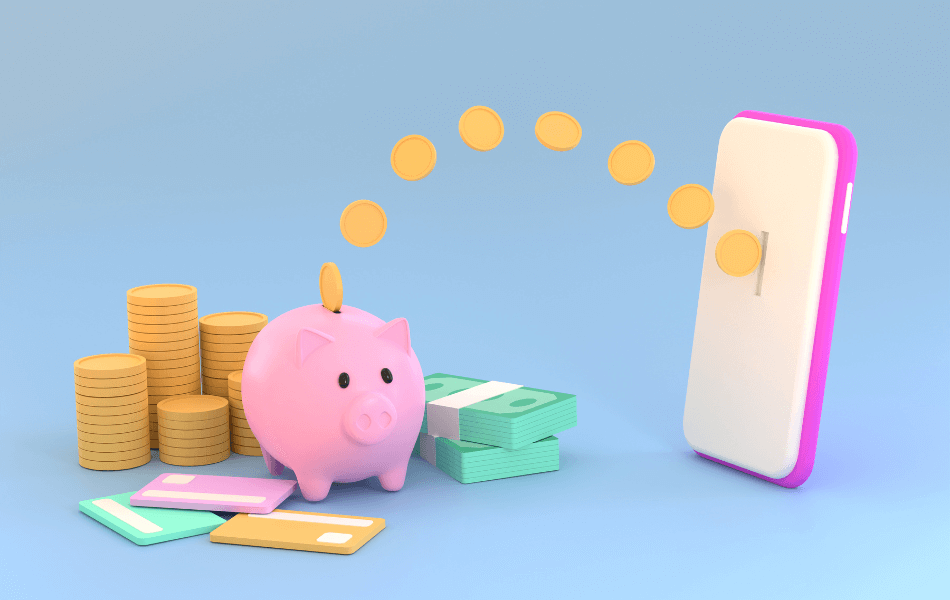

4. Automate Savings

Set up automatic transfers that pull money from your checking account to a dedicated savings account every month. Doing this can help you stay consistent without having to think about manually setting the money aside. Our Digital Banking app makes it easy to manage your finances. You can even utilize the “Savings Goals” feature by creating a financial savings goal and setting up a category, amount, and target completion date to save for.

5. Stay Committed

According to Bankrate’s annual emergency savings report, 1 in 3 Americans had to use some of their emergency savings in the past year. In that same survey, 62% of people stated that they feel behind where they should be in saving for emergencies.

Building an emergency fund takes time and discipline. Stay committed to your goal, and remember that even small contributions add up over time. If an emergency arises, you’ll be glad to have the funds there, ready to help you through the difficult time.

Don’t have an emergency fund set up yet but need cash fast? Launch CU’s Quick Cash Loan provides access to funds to help members manage short-term borrowing needs or unplanned expenses. Members can apply for a loan of up to $1,500 through the Digital Banking app.

FAQs

Where should I keep my emergency fund?

An emergency fund should be kept in a safe, easily accessible account, such as a regular savings or money market account, so you can access the funds quickly when needed.

Should I pause other financial goals while building an emergency fund?

Not necessarily. Many people continue contributing small amounts toward other goals, like retirement, while prioritizing their emergency fund until it reaches a comfortable level.

What qualifies as a true emergency?

True emergencies are typically unexpected, necessary expenses—such as medical bills, urgent home or car repairs, or loss of income—not planned purchases or discretionary spending.

If I use my emergency fund, should I refill it right away?

Yes. Once the emergency passes, it’s a good idea to restart contributions as soon as you’re able so your fund is ready for the next unexpected situation.

Is it okay to use an emergency fund instead of a loan?

Using an emergency fund can help you avoid interest and additional debt. However, loan options—like Launch CU’s Quick Cash Loan—can be helpful when savings aren’t quite there yet.