Personal Loan: Your Key To Holiday Shopping

Still have some holiday shopping left to do? In a perfect world, we’d all have a money tree in the backyard, but since that’s not the case, a little financial help can go a long way. If you find yourself needing extra cash this holiday season, a personal loan can be a smart option, especially if you’re carrying a balance on your credit card.

A personal loan (also known as a signature loan) is offered by a financial institution that relies solely on the borrower’s signature and promise to repay, without requiring any collateral. In this blog, we’ll discuss key benefits to applying for a personal loan to help get your holiday shopping underway.

Key Features:

- Know How Much Your Payments Are

- Only Spend What You Borrow

- Personal Loans Have a Fixed Number of Payments

- Have an Idea of When Your Debt Will Be Paid Off

You Know How Much Your Payments Are

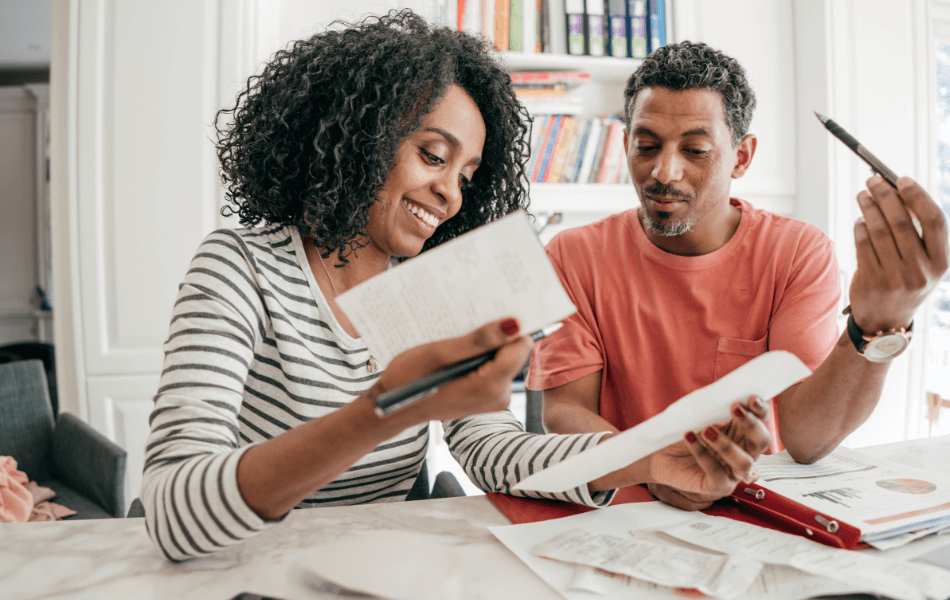

A personal loan allows you to borrow a fixed amount of money. Once you are approved for the loan, your interest rate and repayment terms are established and do not change throughout the course of the loan. This is what we call a fixed payment. Your payment will be the same every month, which lets you create a monthly budget more effectively.

You Only Spend What You Borrow

A personal loan helps keep your holiday spending under control by giving you a set amount to work with. You’ll know exactly what you can spend on each loved one, without the worry of going over budget. And if you have a little left over, you can easily apply it to your loan balance. Plus, with predictable monthly payments and a fixed interest rate, you can enjoy the holidays stress-free knowing your finances are already planned for the season and beyond.

Personal Loans Are Installment Credit

This means your personal loan comes with a fixed number of payments, so you’ll know exactly when it will be paid off. According to Score Info, one factor that can influence your credit score is the amount you owe on revolving accounts, like credit cards. Because a personal loan is considered an installment loan rather than revolving credit, it does not add to your revolving debt. This can help you manage your overall credit utilization and may even have a positive effect on your credit score over time, while giving you a predictable repayment schedule.

You Have a Good Idea When Your Debt Will Be Paid Off

Personal loans are typically a form of short-term lending designed to help you meet specific financial needs. Because your loan comes with a fixed term, you’ll know exactly when it will be fully paid off. This predictability, combined with consistent monthly payments, makes it easier to manage your budget and steadily reduce your debt. With a clear payoff timeline, you can take control of your finances, get your debt behind you, and plan confidently for the future.

FAQ

How can I apply for a personal loan?

Apply online for your personal loan by using our quick and easy web loan application.

What types of personal loans do you offer?

We offer three types of personal loans: signature loans, line of credit, and savings secured.

What are some features of a personal loan from Launch CU?

No application fee, low rates, simple interest, no prepayment penalties, and low-cost Payment Protection is available.