Women and Money: From 1865 to Today… and Beyond

In celebration of Women’s History Month, we’ve put together a list of some of their milestones along the way. Women in America have forged financial progress from 1865 when Pocahontas first appeared on a $20 bill, through today, and beyond.

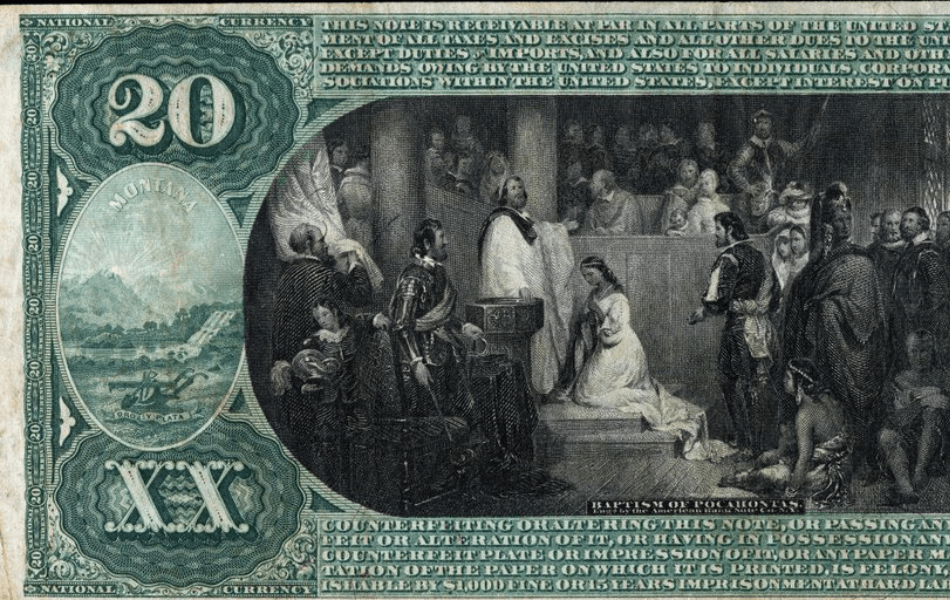

1865: A Real Woman Is Depicted on U.S. Currency for the First Time

Pocahontas became the first actual woman, as compared to the more symbolic Lady Liberty, to be featured on American currency, in this case the $20 bill. This was an honor, of sorts—the Native American woman was depicted kneeling in the midst of a group of men.

1870: First Woman-Owned Brokerage House Opens on Wall Street

Victoria Woodhull, along with her sister Tennessee Claflin, opened the first woman-owned brokerage on Wall Street. A suffragette, Woodhull would also become the first woman to run for president, choosing the abolitionist Frederick Douglass as her running mate.

1875: The First Female Bank President

Louise M. Weiser was named the first woman president of an American bank. She inherited the role at the Winneshiek County Bank in Decorah, IA, following the death of her husband. She held the position until 1892.

1919: First Female Self-Made Millionaire

Sarah Breedlove, who would become famous under the name Madam C.J. Walker, founded a line of haircare products for African American women. Sales of those products and her success at investing in real estate made her one of the country’s first female self-made millionaires.

1963: The Equal Pay Act Is Passed

This landmark legislation was decades in the making—Congress initially failed to pass a Woman’s Pay Act in 1945, despite the work of activists, such as Eleanor Roosevelt, and the changing face of the workforce during the second World War when women took over men’s jobs.

1974: The Equal Credit Opportunity Act

The passage of this act made it illegal for credit card companies and other creditors to discriminate against applicants based on gender, race, religion or national origin. It meant that women on their own, whether single, divorced or widowed, no longer had to have a man come to the bank with them to co-sign on their credit card accounts.

1994: The Family and Medical Leave Act

This law requires employers with more than 50 employees to grant up to 12 weeks of leave during a 12-month period to eligible employees, giving women (and men) the ability to take parental leave without losing their jobs. Despite the FMLA, the United States offers less protection to new families—especially new mothers—than any other developed economy.

2014: The First Female Chair of the Federal Reserve

Janet Yellen became the first female confirmed for the top spot at the central bank of the United States in its 100-year history.

The Future

Research shows that closing the gender gap could increase worldwide gross domestic product by $28 trillion, benefitting both developed and developing nations. The critical areas to address include access to education, inclusive financial services, time spent on unpaid work and legal protections and policies that enable women to enter the workforce.

Sources: Women and Money Milestones