7 Ways To Protect Your Identity

Taking proactive measures to protect your identity is crucial. Identities are stolen every day and people don’t even know when it’s happened to them. According to the FTC, 2.6 million identity and fraud reports were made in one year. Scammers know hundreds of ways to steal your identity so it’s important to know how to protect yourself, so you don’t lose yours.

Key Points

- Identity theft can happen without warning, often before victims realize their information has been compromised.

- Scammers use both digital and physical tactics to steal personal and financial information.

- Simple, proactive habits can significantly reduce your risk of identity theft and fraud.

- Monitoring your accounts, credit, and devices is key to catching suspicious activity early.

1. Keep Your Personal Information Personal

- Stop oversharing on social media.

- Don’t answer calls/text messages from unknown numbers.

- Don’t sign up for services with personal information unless absolutely necessary.

2. Stay Up-to-Date On Scams

- Visit the FTC website for scam alerts.

- Register your phone number on the National Do Not Call Registry.

- Avoid opening emails or text messages from unsolicited senders.

3. Use Secure Passwords

- Don’t use the same password for all accounts.

- Use a password manager like LastPass to store your passwords.

- Utilize multi-factor authentication.

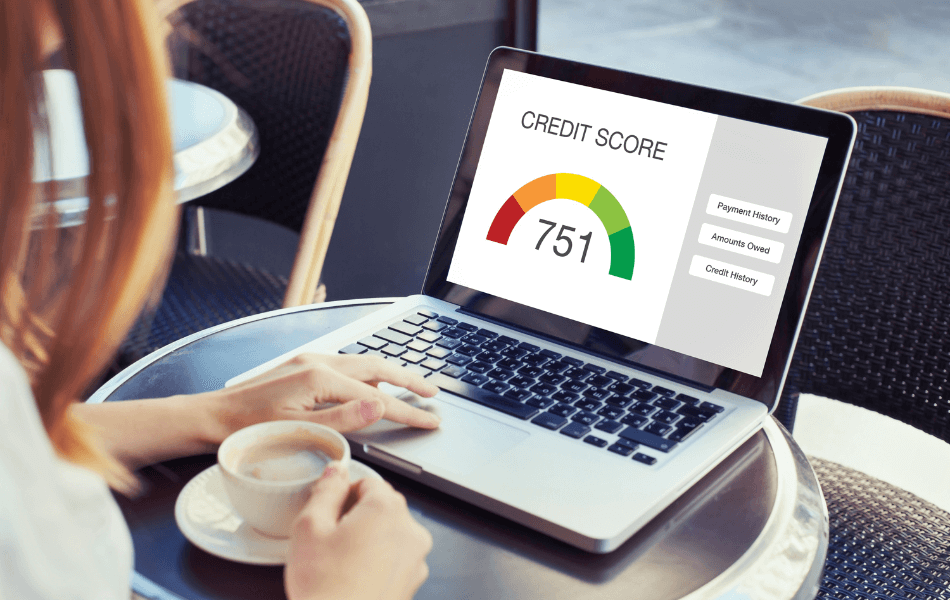

4. Keep An Eye On Your Credit Score

- Check your credit report quarterly.

- Use annualcreditreport.com for a FREE copy.

5. Keep Your Devices Secured

- Turn on automatic updates in your settings.

- Check and see which of your mobile apps have access to information on your phone. You can find this in your settings.

- Clear your browser history.

- Only visit sites with an https address.

- Don’t use unsecured WIFI networks.

6. Watch For Credit Card Skimming

- Cover the keypad when you’re inputting your PIN.

- If you’re at a gas station, pay inside.

- Monitor your debit and credit card accounts regularly.

7. Protect Personal Documents

- Shred personal documents.

- Check your mailbox daily.

If you’re looking for additional ways to protect your identity, check out our 10 Tips To Protect Your Identity.

FAQs

How do I know if my identity has already been stolen?

Common warning signs include unfamiliar accounts on your credit report, bills or collection notices for purchases you didn’t make, denied credit for no clear reason, or unexpected alerts from your bank or credit card company.

What should I do immediately if I suspect identity theft?

Act quickly by placing a fraud alert or credit freeze on your credit report, reporting the issue at IdentityTheft.gov, contacting affected financial institutions, and changing compromised passwords.

What information do scammers value the most?

Social Security numbers, bank account details, login credentials, PINs, and answers to security questions are especially valuable to scammers.

What’s the difference between a data breach and identity theft?

A data breach means your information was exposed, but identity theft occurs when someone actually uses that information fraudulently. Not all breaches lead to identity theft—but they increase the risk.