Credit Score Cheat Sheet

Do you know the three-digit number that plays a major role in your finances? The number that influences your ability to get approved for a loan and what interest rate you receive. The one that can influence your ability to get a certain job, or lease an apartment. It’s your credit score! Decoding your credit score can be confusing because so many factors can affect it. Different scores mean different things and a variety of elements influence the number. We created a helpful credit score cheat sheet so you can understand your unique score.

What Is My Credit Score?

First and foremost, you need to understand what a credit score is. Your credit score is a number used to represent how likely you are to repay your debt. The higher your credit score, the more lenders see you as a responsible borrower. In most cases, the higher your score, the lower your interest rate and the easier your ability to get a loan.

FICO Credit Score Scale®

Understanding your score in relation to the FICO® scale is also important. FICO® scores range from 300 to 850. Anything above 800 indicates to lenders that you are have exceptional credit, while scores 579 and lower indicate poor credit. Let’s break it down.

- 800+: You are an exceptional borrower. According to Experian, if you have a FICO®credit score of 800 or more, your score is much higher than the average U.S. consumer.

- 740 to 799: If you score is between 740 and 799, you are considered to have a very good FICO®credit score. Your score is still above the average U.S. consumer, and you may qualify for better interest rates.

- 670-739: Experian classifies a score between 670 and 739 as good. With a score in this range, you are right in line with the median credit score in the U.S. Financial institutions consider you an “acceptable” borrower.

- 580-669: With a score between 580 and 669 your score is slightly below the average U.S. consumer. FICO® classifies a score between 580 and 669 as fair. In this range, you may find it difficult to obtain a loan, and if you are able to, the interest rate may be higher.

- 579 & Lower: According to Experian, a score that is 579 or lower is classified as a poor credit score. If you are in this range, you may find it very difficult to get approved for a loan. If you are in this range, it does not have to be permanent. There are things you can do to rebuild your score.

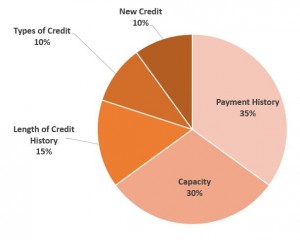

What Elements Impact My Credit Score?

Now that you know where you stack up, it’s important to understand what elements make up your credit score, and how much of an impact each one has.

- Payment History (35%): FICO®advises that the first thing lenders want to know is “Do you pay your debt on time?”

- Capacity (30%): How high is your debt versus your total amount of credit? If a high percentage of your available credit is used, it can signal to lenders that you are more likely to make late payments or have missed payments.

- Length of Credit History (15%): In most instances, longer credit history will increase your FICO®credit score. This includes the age of your oldest and newest accounts, and an average age of all your accounts.

- Types of Credit (10%): Your FICO®score takes into account the mix of debt you have, such as: credit cards, retail store accounts, installment loans, mortgage loans, etc.

- New Credit (10%): Many lenders may see a red flag if they notice that you have opened multiple accounts over a short period of time. This is especially true if you don’t have a long credit history.

So there you have it. You now know what your credit score is, where you sit on the FICO® scale, and what factors determine your FICO® credit score. Keep in mind that there are other elements financial institutions take into consideration when determining your credit worthiness. If you are unhappy with your current FICO® score, follow these tips to start improving it.