Beware of These Travel Scams

Planning a vacation should be exciting… not stressful. Unfortunately, scammers often see travelers as easy targets. Whether you’re booking a dream getaway or already on the road, it’s important to stay vigilant against common travel scams that can cost you time, money, and peace of mind. At Launch Credit Union, we care about your financial well-being both at home and abroad. In this blog, we’ll uncover some common travel scams to look out for and how you can avoid them.

Key Points

- Be cautious of vacation deals, rentals, or giveaways that seem too good to be true, especially those requesting unusual payment methods or upfront fees.

- Book travel, lodging, and transportation only through reputable websites or official apps, and avoid communicating or paying outside secure platforms.

- Stay alert while traveling by protecting your personal information, avoiding unsecured Wi-Fi and ATMs, and verifying taxis or rideshare drivers before entering a vehicle.

- Guard your belongings in crowded or unfamiliar areas by minimizing distractions, keeping valuables secured, and staying aware of your surroundings.

Too Good to Be True Vacation Deals

If you see a vacation package or rental that seems too good to be true, it probably is. Scammers often lure victims with “exclusive” deals on airfare, hotels, or all-inclusive resorts – only to disappear once payment is made.

When searching for vacation deals this summer, be sure to book through reputable travel agencies or directly from official hotel and airline websites. Additionally, be cautious of how you are asked to pay. The FTC warns to never wire money to someone you haven’t met in person.

Fake Rental Listings

Vacation rental platforms like Airbnb and VRBO have grown in popularity thanks to their ease of use and verified host systems. However, not all booking sites offer the same level of protection. Scammers often create fake listings using stolen photos and ask travelers to send deposits upfront.

Always book through trusted platforms, carefully read guest reviews, and steer clear of listings with little or no feedback. Most importantly, never send money or communicate outside the platform’s secure messaging system.

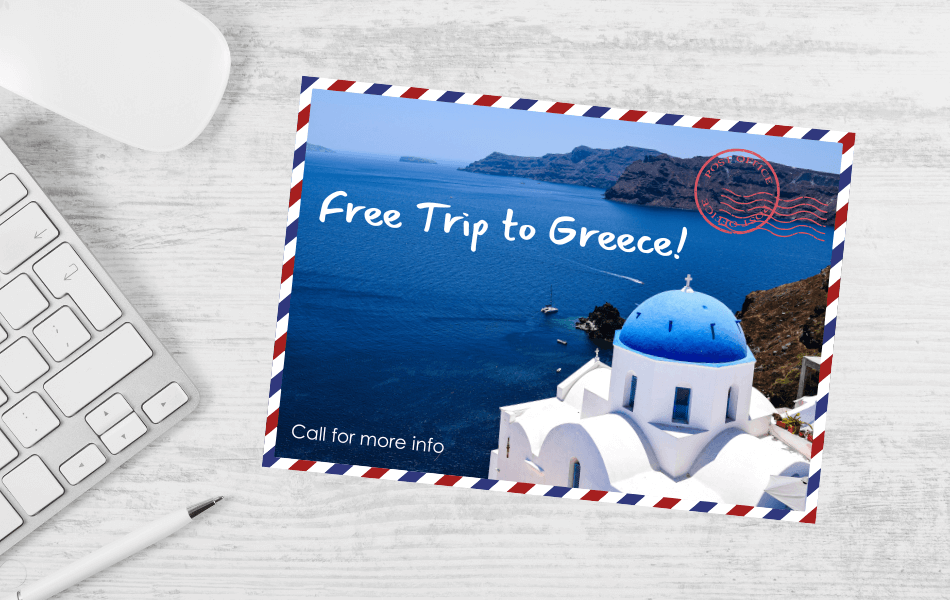

“Free” Vacation Getaway Winner

Winning a free cruise or luxury getaway might sound like a dream come true, but it’s often a phishing attempt or a trap with hidden fees. According to the United States Postal Inspection Service, these offers frequently arrive via letters or postcards promising these free trips. In reality, they often come with hidden strings attached, such as mandatory service fees, pressure to join costly travel clubs, or worse – requests for your credit card information with no trip ever delivered. These scams are designed to lure you in with excitement, only to leave you paying the price.

Transportation Scams

Unsuspecting travelers can easily fall victim to transportation scams, especially in unfamiliar cities. One common scheme involves rigged taxi meters that run faster than normal, dramatically inflating the final fare. In some cases, drivers may take unnecessarily long routes or claim that the meter is broken to charge a flat fee far above the standard rate. Another growing concern is fake rideshare drivers posing as Uber or Lyft drivers. Some will even display branded stickers or signs to appear legitimate. These imposters may target passengers waiting outside airports, hotels, or busy nightlife areas, offering rides without going through the app. Not only can this lead to overcharging, but it also poses serious safety risks.

It’s a good practice to use a trusted taxi service recommended by your hotel or airport. If you use a rideshare service, always use the official app and confirm the driver’s name, license plate, and car model before getting in.

Wi-Fi Scams and ATM Skimming

Free public Wi-Fi may be convenient when you’re traveling – whether you’re checking your flight status, pulling up directions, or searching nearby restaurants. That convenience, however, can come at a cost. Many public networks lack proper encryption, making it easy for cybercriminals to steal your data. This means that any login credentials, emails, or even credit card numbers could be exposed to scammers. For tips on staying safe, check out our blog If It Connects, Protect It: Maximize Security on Your Devices.

Online threats aren’t the only concern. ATM skimming is another common tactic used to target travelers. Skimmers are small devices illegally attached to ATMs that capture your card’s magnetic strip data when you insert it. Some setups also include hidden cameras or fake keypads to record your PIN. Check out Card Skimmers and How to Avoid Them with Contactless Payments.

Pickpocketing and Distraction Scams

In crowded tourist areas, distraction is one of the oldest tricks in the scammer’s playbook. These schemes often involve two or more people working together to divert your attention and separate you from your valuables. One common tactic is the “bump and lift”, where a person might bump into you, drop something, or spill a drink on you to grab your focus. While you’re distracted, an accomplice quietly picks your pocket or snatches your phone or bag.

Other distraction scams include people asking for help with a map, having a child approach you for donations, or even performers creating a spectacle that draws in a crowd. These situations are designed to lower your guard and make it easier for someone to steal from you.

Stay alert in busy areas and avoid displaying valuable items. If you’re heading to a crowded area, consider wearing a crossbody bag with a zipper and keep it positioned in front of you. This makes it significantly more difficult for pick pocketers to access your belongings without being noticed.

FAQs

How can I tell if a vacation deal is legitimate?

Legitimate travel deals usually come from well-known companies, have clear terms and conditions, and allow secure payment methods. Be cautious of high-pressure tactics, limited-time claims, or requests for payment through wire transfers, gift cards, or cryptocurrency.

Are travel scams more common during certain times of the year?

Yes. Scams tend to increase during peak travel seasons like summer, holidays, and school breaks, when more people are booking trips and scammers know travelers may be distracted or rushed.

Is it safe to book travel through social media ads?

Social media ads can be legitimate, but scammers often use them to promote fake deals and rentals. Always verify the company, read reviews outside the platform, and book directly through official websites whenever possible.

What are red flags that a rental listing may be fake?

Red flags include prices far below market value, pressure to pay quickly, requests to move communication off the booking platform, vague property details, and limited or generic reviews.

How can I avoid being targeted as a tourist?

Blend in when possible, avoid displaying valuables, stay aware of your surroundings, and be cautious when approached by strangers offering unsolicited help or deals.