Home Loan & Home Buying Myths To Ditch Today

Thinking about making the leap from renting to owning a home? If homeownership has been on your mind, chances are you’ve started researching online or seeking advice from family and friends who’ve already been through the process. Unfortunately, the home buying journey is often clouded by common myths and misinformation. That’s why we’ve put together a list of the top 9 home buying myths to debunk before you apply for a mortgage.

Key Points

- Many common homebuying myths can prevent buyers from moving forward, including misconceptions about down payments, credit scores, inspections, and closing costs.

- Mortgage options, loan terms, and affordability vary widely, making it important to understand what you can realistically afford before shopping for a home.

Skipping steps like inspections or focusing only on interest rates can lead to costly mistakes; service, guidance, and long-term value matter. - Homeownership may be more attainable and financially beneficial than many first-time buyers realize, especially with the right lender and preparation.

1. You Need a Huge Down Payment

While many mortgage lenders will require you to put a 20% down payment on a home, there are other mortgage lenders who do not have such strict requirements. At Launch CU we believe in providing those in the communities we serve with affordable home loan products. That’s why we offer home loans with down payments as low as 3%.

2. You Won’t Qualify if Your Credit Score Is Too Low

If your credit score is holding you back from applying for a home loan, keep on reading. Many people believe you have to have A+ credit to get approved for a home loan; this is not necessarily the case. While having a credit score in the 700’s will improve your chances of getting approved for a mortgage with a lower interest rate, there are many other factors that are taken into consideration when a mortgage lender reviews your mortgage application. Utilize FICO’s® loan savings calculator to help you determine how your credit score would impact the interest you pay on a mortgage, and remember a friendly Launch CU Home Loan Specialist is only a phone call away.

3. You Can Skip the Inspection

According to realtor.com, 1 in 4 homebuyers opt to waive a home inspection. You might feel pressured to skip a home inspection, especially if you’re worried about losing out on your dream home — but doing so is never worth the risk. No matter how perfect a home may seem, you should never waive the inspection. Forgoing it means accepting the property as-is, along with any hidden issues it may have. And those issues can be costly — think mold, asbestos, leaky pipes, or a compromised roof. Remember, serious problems aren’t always visible during a walk-through. A professional inspection helps protect your investment and gives you the clarity you need to make an informed decision.

Check out our blog, What Should You Inspect When Buying a House?

4. The First Step is Shopping For a Home

If you’re like most first-time homebuyers in Florida, you’ve probably already started browsing homes online. While it feels like a natural first step, it’s actually not the best place to begin. The real first step is understanding what you can realistically afford. Before falling in love with a home outside your budget, take a moment to use a home affordability calculator to estimate your price range. Then, use a mortgage payment calculator to get a clearer picture of what your monthly payments might look like. These simple tools can save you time — and spare you the disappointment of discovering that your dream home is financially out of reach.

5. The List Price Is the Final Price

Think back to the last time you bought a car, did you pay the sticker price, or did you negotiate for a better deal? Buying a home works much the same way. The listing price isn’t set in stone, and your initial offer doesn’t have to match it. A knowledgeable real estate agent who understands your local market can help you craft a competitive yet reasonable offer. And if your home inspection reveals any issues, those findings can be powerful leverage in negotiating a lower purchase price or requesting repairs before closing.

6. A 30-Year Mortgage Is Always the Best Option

While 30-year mortgages are popular among first-time homebuyers in Florida, that doesn’t necessarily mean they’re the best fit for everyone. A 15-year mortgage, for example, comes with higher monthly payments but significantly less interest paid over the life of the loan.

Here’s why: In the early years of your mortgage, most of your payment goes toward interest, since the loan balance is still high. With a 15-year term, you’re paying down the principal faster, which means you reach the point where more of your payment goes toward the principal and less toward interest much sooner than with a 30-year loan. As a result, a shorter term can save you thousands in interest over time.

To figure out which term is right for you, use Launch CU’s comparing mortgages calculator to estimate your payments and total costs.

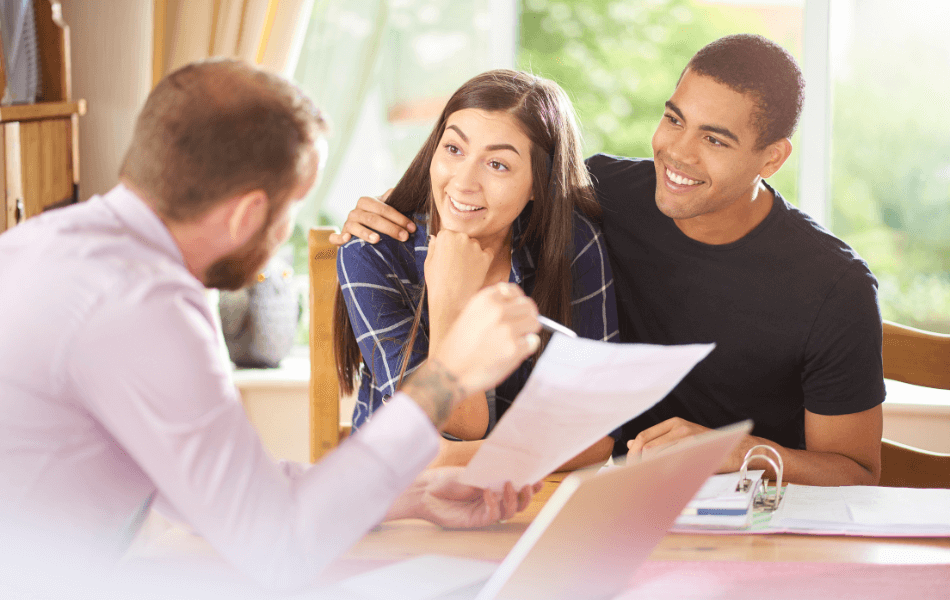

7. Lower Rate Is More Important Than Service

It might be tempting to go with an online mortgage lender offering the lowest rate, but remember — your relationship with your lender doesn’t end at closing. You’ll likely be working with them for years, even if you refinance down the road. That’s why it’s important to consider more than just the rate. Great service matters just as much as a great deal.

You want a lender who’s easy to reach, responsive, and reliable. Nothing is more frustrating than waiting days, or even weeks, for a reply from a lender located across the country or overseas, especially when you have a time-sensitive question.

At Launch CU, we combine competitive mortgage rates with exceptional service. We don’t sell your mortgage, so you’ll always know exactly who to contact when you need help. We understand that buying a home can feel overwhelming, that’s why we’re here for you, every step of the way.

8. Renting Is Always Cheaper

If you’ve ever Googled “Is owning a home cheaper than renting?” you’ve likely come across countless opinions and conflicting advice. Friends and family may have shared their own experiences, making it even harder to find a definitive answer. But if you’ve concluded that renting is always the cheaper option, think again.

According to research by Trulia, owning a home is actually 35% less expensive than renting on a national average. While homeownership does come with additional responsibilities, every mortgage payment you make helps you build equity, which is something rent can never offer. In the long run, owning a home can be a smarter financial move that invests in your future.

9. I Won’t Be Responsible For Any Closing Costs

One common myth in real estate is that the seller always covers all closing costs. While sellers may pay some of the costs in certain situations, it’s far more common for buyers to be responsible for a portion — if not the majority — of these expenses. That’s why it’s essential to include closing costs in your home buying budget. Being prepared for these additional costs can help you avoid surprises and ensure a smoother path to homeownership.

Are You Ready to Apply For a Home Loan?

Whether you are ready to become a home buyer now, or in the distant future, it’s important to remember these nine home buying myths before you start your home buying journey. A priority is to find a mortgage lender that offers competitive mortgage rates and great servicing. Remember, you will be in a partnership with this mortgage lender often times for decades. You want to pick a partner with a good reputation and a history of offering personalized one-on-one service.

For more information about Launch CU mortgages, visit our mortgage page or contact a Launch CU Home Loan Specialist today at 321-456-5439. We are here to serve you.

FAQs

When should I talk to a lender during the home buying process?

It’s best to speak with a lender early—before seriously shopping for a home. This helps you understand your budget, loan options, and what to expect throughout the process.

What documents do I need to apply for a mortgage?

Common documents include recent pay stubs, tax returns, bank statements, and information about your debts and assets. A loan specialist can provide a personalized checklist.

What’s the difference between prequalification and preapproval?

Prequalification is an estimate based on self-reported information, while preapproval involves verifying your financial details and provides a clearer picture of your borrowing power.

What expenses should I expect after buying a home?

Homeownership includes ongoing costs such as property taxes, insurance, utilities, maintenance, and repairs. Planning ahead helps avoid financial stress after closing.