8 Financial Tips for High School Seniors

Updated: July 18, 2025

The real world is right around the corner for high school seniors! If you know someone preparing for college, now is the perfect time to share practical financial tips. Once classes begin, students will have plenty to juggle—so getting a handle on personal finances early can make a big difference. College is costly enough without the added burden of poor money habits. And while these tips are geared toward students, they’re helpful for anyone looking to sharpen their financial skills.

1. Open a Bank Account

Opening a bank account is a great first step in activating your financial freedom as an incoming college student. Having a checking and savings account allows you to keep track of your money, and your family has the ability to quickly send you funds if needed. Have a debit card that is accepted everywhere, so you can make necessary purchases and obtain money when you need it.

2. Start Saving Now

Summer jobs are a great way to earn extra cash before heading to college. Remember, set aside some of your earnings for the upcoming year. This extra cash comes in handy for textbooks and food outside of your dining plan.

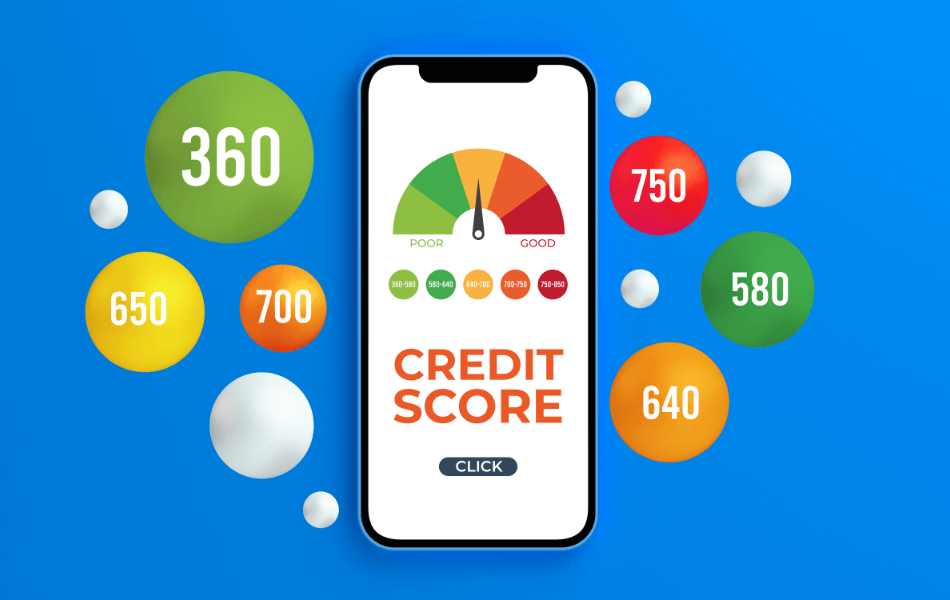

3. Learn About Your Credit Score

- Don’t apply for multiple credit cards

- Become an authorized user on your parents’ account

- Make small purchases on a credit card and pay them off monthly.

4. Start a Budget

If you’ve never followed a budget then now is the time to do so. You’ll have enough on your plate with classes, extracurricular activities, and study groups. Don’t put an extra load on your shoulders worrying about money. Write down all your expenses and all your income. Divvy up what money you need for bills, textbooks, events, etc. Then, choose what to do with leftover funds.

5. Review Financial Aid

Visit the FAFSA website and review your Student Aid Report. Make sure all the information is correct and current. If you received more loans than you need, you may want to consider declining some. While the extra money may be nice, once school is over, you’ll have to pay these back + interest. It’s best to only take what you need.

Check out this YouTube video: Student Loans 101

6. Look for Student Discounts

Hundreds of companies offer student discounts on their products, so don’t miss out! Apple provides a new student 15% discount every year. Another great one is Amazon’s 50% discount for prime services.

7. Avoid Brand New Text Books

College textbooks can be extremely expensive and add up very fast. If you can, buy a used version. Look for a book exchange near your school that offers used textbooks for a discounted rate. Also, check the school’s library to see if they have the book available. Search for the “e-book” version or split the cost with a classmate.

8. Protect Your Identity

This is an important one! Enrolling in college means you’ll provide the school with personal information for tuition and housing purposes. Always verify who the information is being sent to. Double-check the email address or website link you’re using to send your information. Learn more about security tips and identity theft.

We know the future can be intimidating, and it’s easy to get stressed out when it comes to financial decisions. Launch Credit Union is here to help. We hope these financial tips are a great start to achieving financial success in the upcoming school year.